what is considered income for child support in colorado

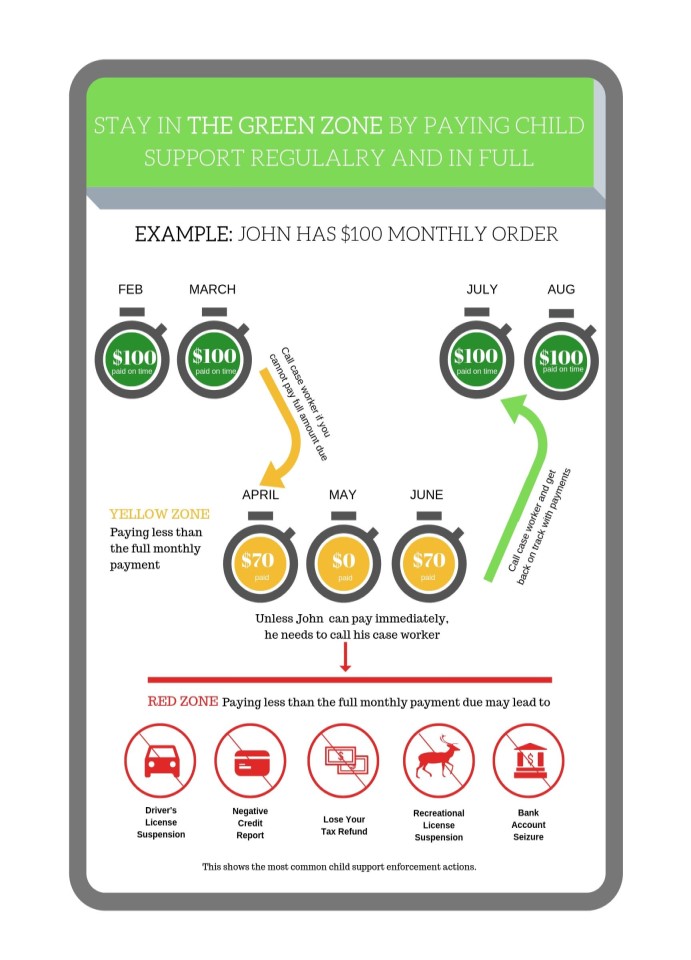

Which moneys must be considered income from self -employment. Forfeit a drivers license business license or an income tax refund.

Child Support Services Human Services

Cases in Alaska Colorado Montana and Ohio have held that the interest on an IRA is income for purposes of child support.

. 7031 Koll Center Pkwy Pleasanton CA 94566. In Colorado every child has the right to be financially supported by his or her parents whether the parents are married to one another or not. July 1 2021.

Use the eligibility calculator to find out if you are eligible for Colorados programs and services to keep residents healthy. The guidelines use a formula based on what the parents would have spent on the child had they not separated. Social security benefits including social security benefits actually received by a parent as a result of the disability of that.

For example if a new husband gives his wife a trust that pays her 10000 in. Please remember that these calculators are for informational and educational purposes only. Other child support orders.

Be fined or jailed. Although the trial court increased child support to 103210 it did not calculate or include the capital gains. The Colorado Child Support Guidelines are designed to make sure that a fair share of each parents income and resources are given to their child.

Free no obligation consult with a lawyer. Other child support. Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support.

4 work and education related child care costs. Only Revised October 2021. The amount of child support a court will order for any particular case may be different from the amount estimated by the calculator.

Federal Poverty Level Calculator. Income can refer to. The following may be factored into the formula.

1 monthly income of both parties. Similarly What is considered income for child support in Colorado. An overview of how child support is determined in Colorado.

In the state of Colorado income that can be used for child support is income that is obtained from any sourceBasically this means that you are responsible for reporting any money that you receive with the. The Basics You Should Know About Child Support Calculations in Colorado. 2 number of children.

Income can include more than just gross employment pay and self-employment income. What is considered income for child support in colorado. Colorado Child Support Guidelines For cases on or after.

Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan. Income for Child Support Calculations. It is therefore vital that parents understand what funds can be considered income under the child support guidelines and what funds are excluded from the definition of income.

CRS 14-10-115 provides a complicated list of various types of income which are included in the Colorado child support calculations. Under Colorado law the amount of child support that is determined in a child support action is typically tied to the income of the parties. The main factors include.

Income Part 1 In Colorado numerous factors go into calculating child support. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. A parent who is not meeting a child support obligation may.

Lose the right to request an accounting of child support. Tanis decided to ask for an increase in child support arguing among other things that the court should include the gain from the sale of his house about 60000 in Mr. This article examines what Colorado considers as income in determining child support obligations.

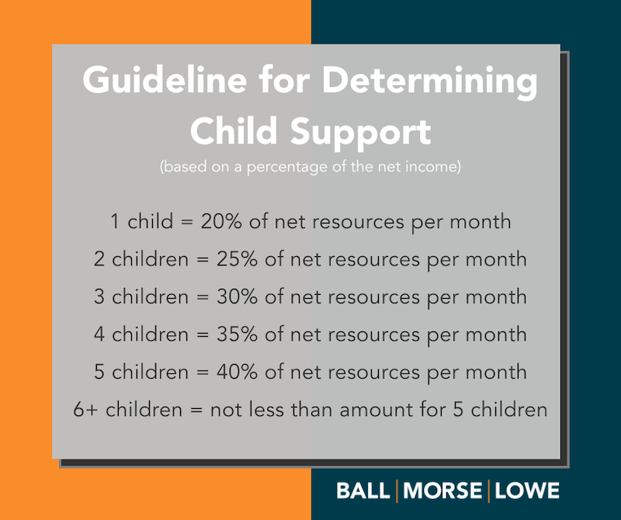

The monthly obligation is. 50 for 1 child. Affects child support is in the rare circumstance where a new spouse provides the parent money each month that could be considered income.

Be sure that you understand your rights and options when it comes to all aspects of your divorce. The guidelines use a formula based on what the parents would have spent on the child had they not separated. 90 for 3 children.

Colorado law specifically indicates this is not true. The Colorado Child Support Guidelines include a list of factors judges can consider when calculating a child support award. Many of these programs are available to those that meet certain requirements including income requirements.

The more income a party has the greater is their share of support obligation. Much of the confusion of the definition of income in many states comes from the fact that state child support statues do not define exact. Proof of payment to have any expense considered.

All income sources are considered including. Those income numbers are based on the Federal Poverty Level FPL. In the state of Colorado the amount of child support that a parent will receive in order to care for their child is a decision that is made based on the income of both parents as well as the general expenses of the child.

As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent. It also lists other types of income which are not included. The Colorado alimony statute CRS.

Income can refer to more than just the wages you earn at your place of employment however. 70 for 2 children. 14-10-115 Colorado Child Support Guidelines has been updated three times in the last five years.

Worksheet A Sole Physical are is used in cases when one parent has 92 or. However it is important to remember that even for income levels where there is a guideline alimony formula the formula is just a guideline. 14-10-114 outlines a number of different factors to be considered by the Court when making alimony determinations which can cause the alimony number to fluctuate greatly or not at all.

Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional. A guideline worksheet is a form used to calculate the amount of child support that is owed. It is an equation set up so that the parent who is responsible for the child can afford to take care of the child.

Your employer is only allowed to take. 3 annual overnights with each parent. Conversely cases in New Mexico.

For example if the father earns 40000 per year and the mother earns 60000 per year combined 100000 per year then the father is responsible for 40 of the child support. The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. This includes a 2018 change to how the courts define adjusted gross income and alimony or maintenance received.

A parents income is a key factor in deciding how much financial support is owed. 5 the children. In 1994 Ms.

Lose a tax exemption for a child. Colorado has two guideline worksheets.

Is Child Support Tax Deductible Colorado Legal Group

Enforcing Orders Colorado Child Support Services

Calculate Child Support Payments Child Support Calculator Colorado Company Announces Online Solution To Calcul Child Support Quotes Child Support Supportive

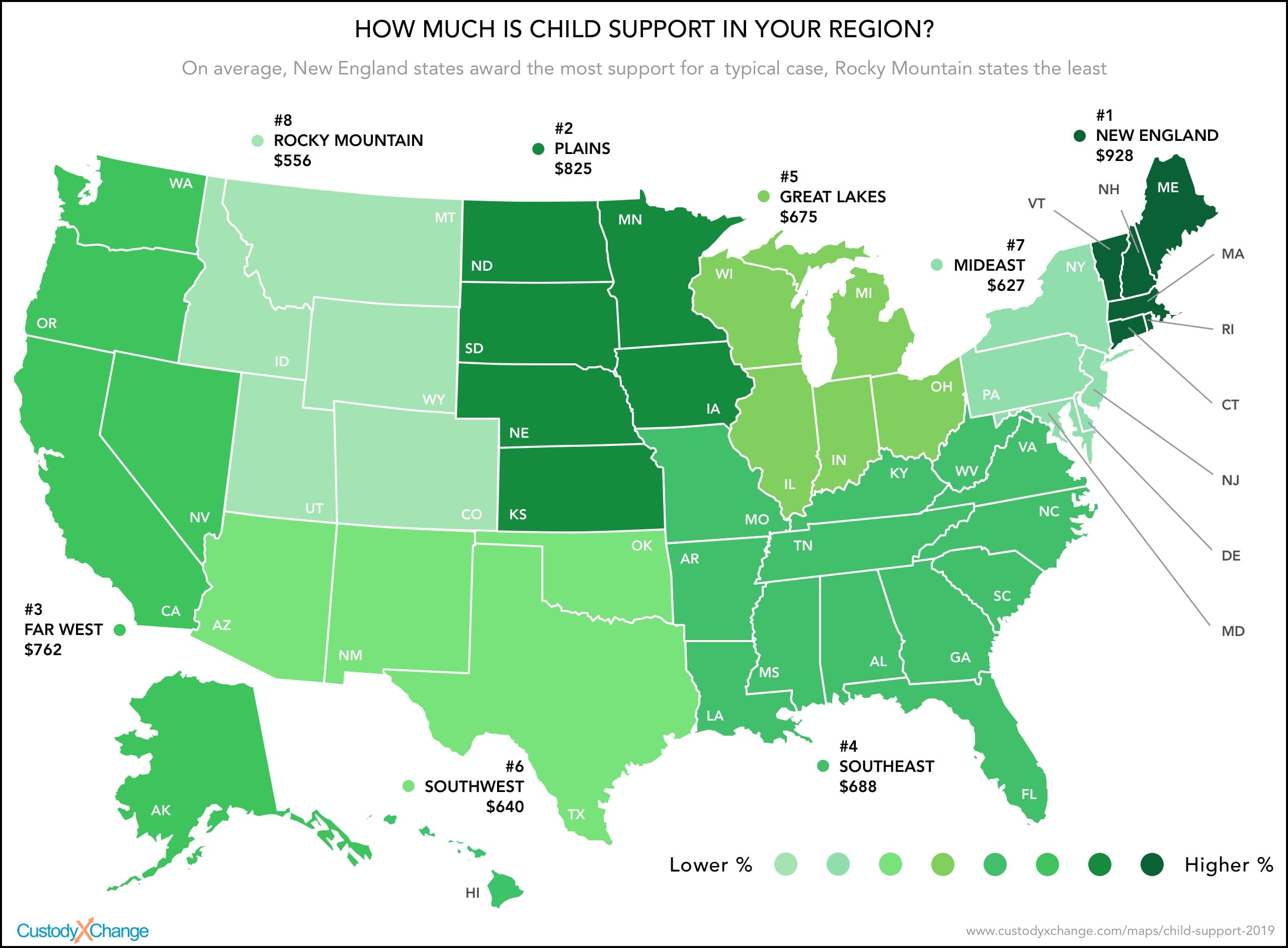

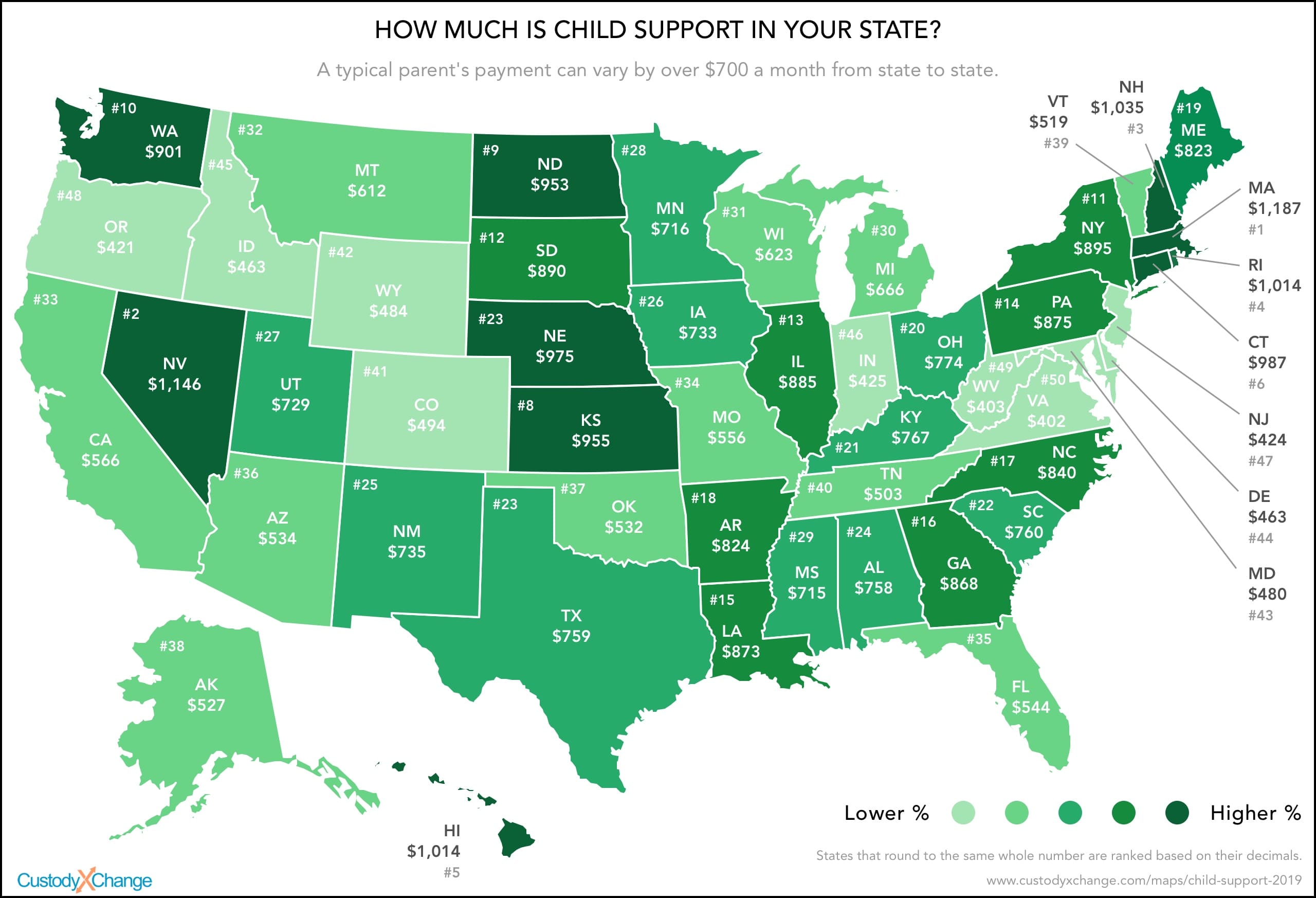

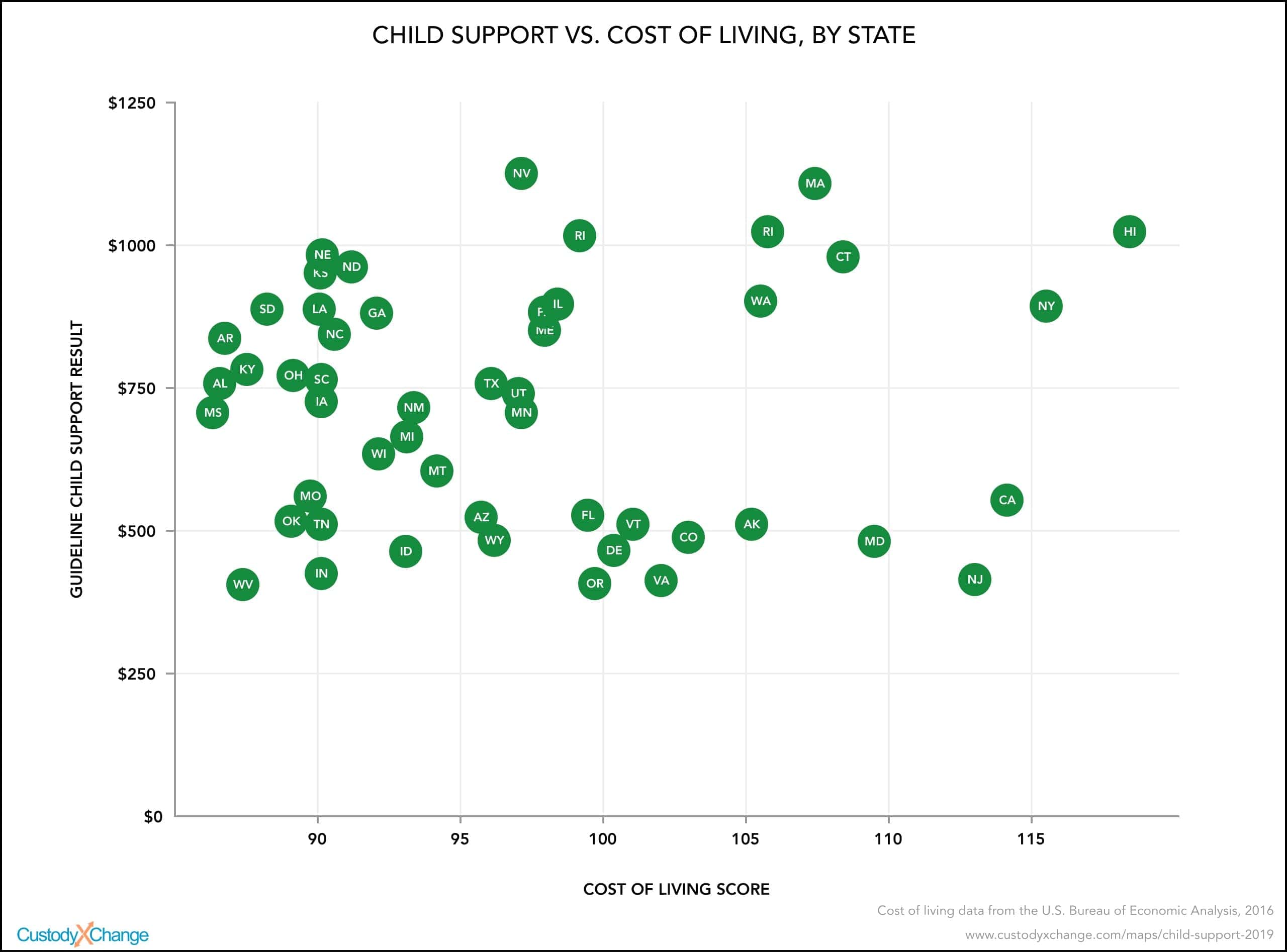

How Much Is Child Support In Your State Custody X Change

Frequently Asked Questions Colorado Child Support Services

How To Modify A Child Support Order In Colorado

Child Support Basic Obligation Colorado Family Law Guide

Child Support Modification Termination Colorado Family Law Guide

Child Support Financial Laws Responsibilities

Child Support An Essential Guide 2022

Child Support In Texas How It Works

Does Child Support Increase If Salary Increases Goldman Law Llc

How Much Is Child Support In Your State Custody X Change

Child Support An Essential Guide 2022

How Much Is Child Support In Your State Custody X Change

How To Calculate Child Support In Georgia 2018 How Much Payments